LenderLogix expands LiteSpeed POS with native eSignature for borrowers and loan teams

BUFFALO, N.Y., Dec. 16, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced LiteSpeed eSign, a fully native eSignature experience built into the LiteSpeed point of sale (POS) platform. Serving both sides of the mortgage process, LiteSpeed eSign enables lenders to tag and request documents for electronic signatures directly in Encompass without the need to switch platforms.

LenderLogix expands LiteSpeed POS with built-in AI-powered agent for mortgage loan officers

BUFFALO, N.Y., Nov. 10, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced it has launched AI Sidekick, an artificial intelligence (AI) feature built into the LiteSpeed point-of-sale (POS) platform. AI Sidekick supports loan officers (LOs) with simple tools to instantly review loan files, efficiently update document needs lists and rapidly identify missing data, reducing loan processing times by up to 40%.

LenderLogix CTO and Co-Founder Scott Falbo recognized as a 2025 HousingWire Tech Trendsetter

BUFFALO, N.Y., Nov. 3, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced its CTO and Co-Founder Scott Falbo is a 2025 HousingWire Tech Trendsetter. The award honors technology leaders and innovators whose work is driving meaningful change across the housing industry. Falbo was recognized for his role in advancing automation, borrower experience and lender efficiency through thoughtful, practical innovation.

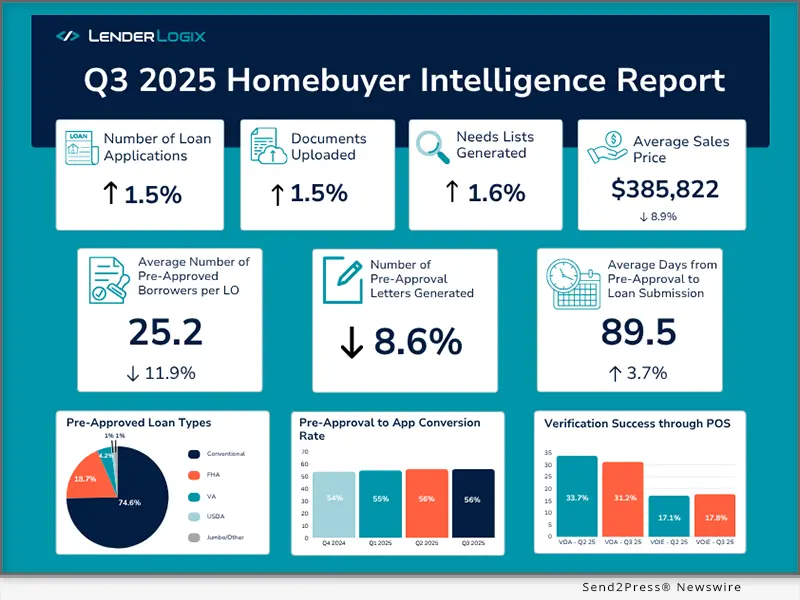

LenderLogix Q3 2025 Homebuyer Intelligence Report Reveals Subtle Shifts in Pre-Approval Volume and Post-App Behavior

BUFFALO, N.Y., Oct. 16, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the third quarter (Q3) of 2025.

Peak Residential implements Argyle-LenderLogix integration – LiteSpeed first POS to integrate with Argyle VOA

BUFFALO, N.Y., Oct. 2, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale (POS) and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Peak Residential Lending (Peak) has adopted LenderLogix’s LiteSpeed(tm) integration with Argyle to deliver verification of assets (VOA) directly at the point of sale (POS). LiteSpeed is the first POS to offer VOA through Argyle’s verification platform.

LenderLogix CEO Patrick O’Brien honored as 2025 HousingWire Vanguard

BUFFALO, N.Y., Sept. 2, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced its founder and CEO Patrick O’Brien has been recognized as a 2025 HousingWire Vanguard. The award honors C-suite professionals and business leaders whose vision and leadership are driving the housing industry forward across lending, servicing, investments, and real estate.

New financing options and Labor Day event happening at reopened New York American Freight stores

BUFFALO, N.Y., Aug. 22, 2025 (SEND2PRESS NEWSWIRE) — American Freight is hosting a Labor Day event, August 13 to September 7, 2025, reopened in New York, with a location in Buffalo. Under new ownership and a renewed strategic direction, the stores also offer new buying options, improved customer service, and the same unbeatable prices that American Freight has been known for since 1994.

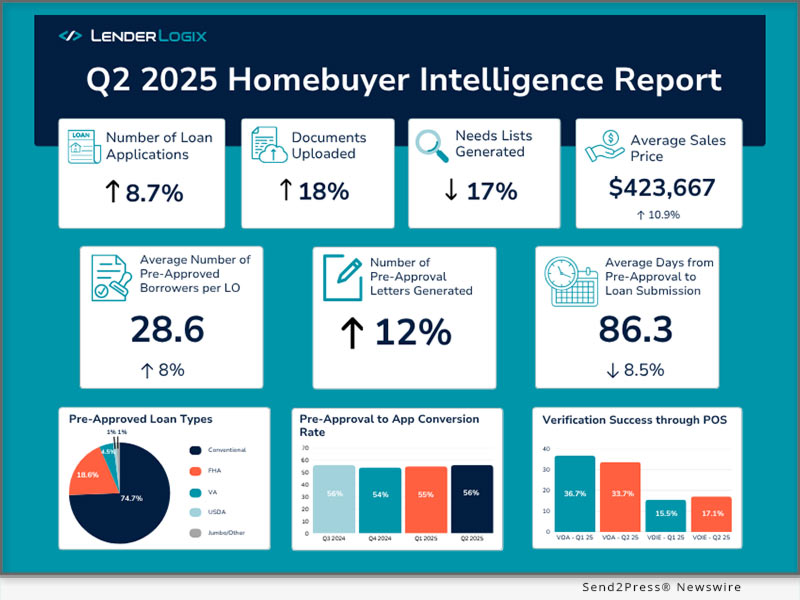

LenderLogix Q2 2025 Homebuyer Intelligence Report Shows Increased Loan Quantities as Borrower Activity Holds Steady

BUFFALO, N.Y., Aug. 5, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the second quarter (Q2) of 2025.

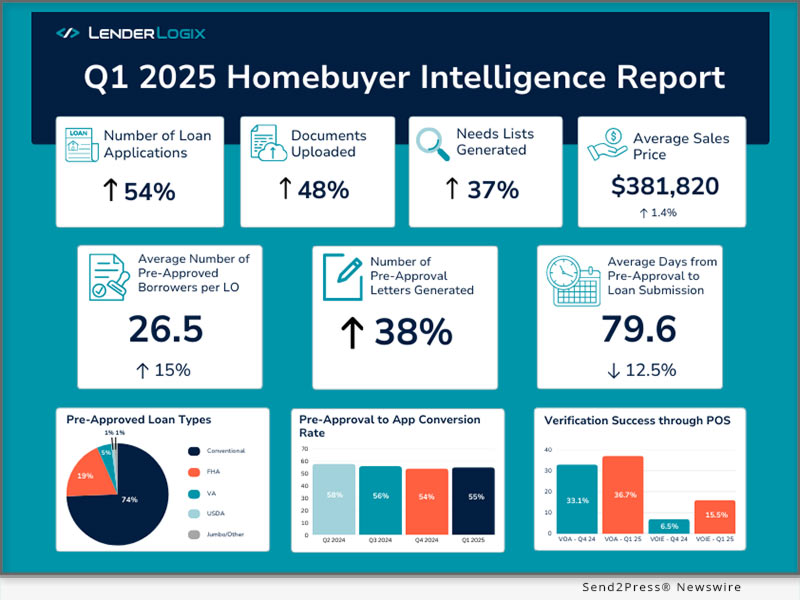

LenderLogix Q1 2025 Homebuyer Intelligence Report Shows Early 2025 Mortgage Market Momentum, Stronger Loan Engagement

BUFFALO, N.Y., May 6, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the first quarter (Q1) of 2025.

Victorian Finance Switches to LiteSpeed by LenderLogix for Point-of-Sale

BUFFALO, N.Y., April 29, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced that Victorian Finance, an independent mortgage lending company, has implemented LiteSpeed™ to replace its legacy point-of-sale (POS) system. Victorian Finance will use LiteSpeed to provide borrowers with an automated, digital-first mortgage experience.

LenderLogix Q4 2024 Homebuyer Intelligence Report Data Indicates Possible Improvement in Affordability

BUFFALO, N.Y., Jan. 21, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the fourth quarter (Q4) of 2024.

New #1 Hit Children’s Book ‘Everyone Is Perfect for Just Who They Should Be’ Inspires Self-Love and Universal Kindness

BUFFALO, N.Y., Dec. 31, 2024 (SEND2PRESS NEWSWIRE) — Author and reality TV personality Johnny Stanz has released his debut children’s book, “Everyone Is Perfect for Just Who They Should Be” (ISBN: 978-0228895190), published on December 12, 2024, by Tellwell Publishing. This beautifully written poem teaches readers of all ages the importance of kindness, self-acceptance, and celebrating the differences that make each person unique. The book has already reached #1 as a Hot New Release in Amazon.com’s Children’s Multiculturalism & Tolerance category.

US Mortgage Corporation Taps LenderLogix LiteSpeed to Replace its Legacy Point-of-Sale

BUFFALO, N.Y., Oct. 23, 2024 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced US Mortgage Corporation, a nationwide mortgage lender, has selected LiteSpeed to automate its mortgage process and provide its borrowers a digital-first borrower experience.

LenderLogix Q3 2024 Homebuyer Intelligence Report Data: Homebuyers Hold Steady and ‘Wait for the Rate’

BUFFALO, N.Y., Oct. 17, 2024 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the third quarter (Q3) of 2024.

M2 Lending Solutions Taps LenderLogix to Provide Automated, Digital-First Borrower Experience

BUFFALO, N.Y., Sept. 24, 2024 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, recently announced the addition of M2 Lending to its roster of clients utilizing LiteSpeed, QuickQual and Milestone Text Updates.

LenderLogix adds mortgage sales expert Ben Head as account executive

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced Ben Head has joined the company as an account executive responsible for expanding LenderLogix’ market share.

LenderLogix’s Patrick O’Brien Recognized as a 2024 HousingWire Vanguard Honoree

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced Co-founder and CEO Patrick O’Brien has been selected by HousingWire as a 2024 Vanguard Award winner.

LenderLogix Integrates Income, Employment Verification Services from Truv into LiteSpeed Mortgage Point-of-Sale

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced its integration with automated employment and income technology provider Truv. Through the integration, lenders can now access Truv’s consumer-permissioned data platform through LenderLogix’s point-of-sale (POS) LiteSpeed to obtain direct-to-source income and employment verification for mortgage applicants.

LenderLogix Q2 2024 Homebuyer Intelligence Report Data Shows Home Buying Activity and Fees Collected by Fee Chaser Remain Steady Thus Far in 2024

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process during the second quarter (Q2) of 2024.

American Pacific Mortgage Picks Fee Chaser by LenderLogix to Collect Upfront Borrower Fees

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, recently announced the addition of American Pacific Mortgage to its roster of clients utilizing Fee Chaser. Employing Fee Chaser enables American Pacific Mortgage to efficiently and compliantly collect initial mortgage-related fees from borrowers.

LenderLogix Q1 2024 Homebuyer Intelligence Report Data Shows Increase in Home Buying Activity and Fees Collected by Fee Chaser

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process during the first quarter (Q1) of 2024.

LenderLogix Announces POS Integration with Informative Research’s AccountChek to Enhance the Mortgage Borrower Experience

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, announced the integration of AccountChek by Informative Research into its point-of-sale system LiteSpeed. This integration blends AccountChek’s pioneering verification technology into LiteSpeed to seamlessly enhance the borrower experience and optimize the loan origination process to ensure a smooth experience for borrowers and users alike.

LenderLogix Celebrates its Third Appearance on HousingWire’s annual Tech100 List of Innovative Mortgage Technology Firms

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced it has been named to HousingWire magazine’s annual Tech100 list. The Tech100 award seeks to highlight the most innovative technology companies across the housing sector.

LenderLogix Q4 2023 Homebuyer Intelligence Report Data Shows Steady Home Buying Activity

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process during the fourth quarter (Q4) of 2023.

Legacy Mutual Selects LenderLogix’s QuickQual to Improve Transparency and Responsiveness During Mortgage Borrowers’ Home Search

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Legacy Mutual Mortgage has selected its pre-approval letter generation tool QuickQual to provide borrowers with a white-labeled, digitally-driven entry point into their homebuying experience.

LenderLogix Co-Founder and Chief Technology Officer Scott Falbo named a 2023 HousingWire Tech Trendsetter

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced Co-founder and Chief Technology Officer Scott Falbo has been selected by HousingWire as a 2023 Tech Trendsetter Award winner. In its fifth year, HousingWire’s Tech Trendsetters award recognizes the most impactful and innovative technology leaders serving the housing economy.

Encompass Lending Group Adds LiteSpeed and QuickQual from LenderLogix to Its Digital Mortgage Tech Stack

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced that Encompass Lending Group, a wholly owned subsidiary of Fathom Holdings Inc. (Nasdaq: FTHM), has selected its streamlined point-of-sale (POS) platform LiteSpeed and QuickQual, a loan origination system (LOS) add-on that allows prospective borrowers and real estate agents to run payment and closing costs scenarios.

LenderLogix Q3 2023 Homebuyer Intelligence Report Data Shows Slight Decline in Home Buying Activity

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools.

Affinity Plus Federal Credit Union Selects LenderLogix’s QuickQual to Improve Transparency and Responsiveness During Mortgage Borrowers’ Home Search

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Minnesota-based Affinity Plus Federal Credit Union (Affinity Plus) has selected its pre-approval letter generation tool QuickQual to provide borrowers with a white-labeled, digitally-driven entry point into their homebuying experience.

LenderLogix integrates LiteSpeed mortgage point of sale system with Encompass by ICE Mortgage Technology

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced the completion of the integration between LiteSpeed, a streamlined point-of-sale (POS) system designed for mortgage lenders and Encompass® by ICE Mortgage Technology, part of ICE (NYSE: ICE) and a global data, technology and market infrastructure company that designs, builds and operates digital networks to connect people to opportunity.

LenderLogix’s Derrick Enderby recognized by HousingWire Magazine in its 2023 HW Insiders award program

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced Director of Customer Success Derrick Enderby has been chosen by HousingWire as a 2023 Insiders Award winner.

Northwest Bank Collects Fees within Minutes with LenderLogix FeeChaser

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced Northwest Bank has selected its payment processing platform Fee Chaser to ensure compliant collection of upfront fees and deliver borrowers a five-star digital experience.

LenderLogix Q2 2023 Homebuyer Intelligence Report Data Shows Slight Increase in Homebuying Activity Despite Affordability and Inventory Challenges

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools.

Premium Mortgage Corporation taps LenderLogix’s LiteSpeed to power Digital-First Mortgage Borrowing Experience

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Rochester, N.Y.-based Premium Mortgage Corporation (Premium Mortgage) is the latest mortgage lender to implement its streamlined point-of-sale (POS) platform LiteSpeed to provide borrowers with a white-labeled, digitally-driven mortgage application experience.

LenderLogix Announces Quarterly Homebuyer Intelligence Report

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today introduced the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The inaugural report covers data collected during the pre-approval and borrower application process during the first quarter (Q1) of 2023.