Blue Sage Solutions and The Mortgage Collaborative Partner to Bring Interim Servicing to their Members

ENGLEWOOD CLIFFS, N.J. /ScoopCloud/ — The Mortgage Collaborative, the nation’s largest independent mortgage cooperative, announced the addition of Blue Sage Solutions, an industry leader in innovative cloud-based technology providers, to bring interim servicing to the mortgage industry. The partnership makes the Blue Sage Digital Servicing Platform (DSP), a cloud-based system that provides all necessary functions to perform interim servicing, available to TMC members at preferred rates.

FormFree appoints Solvent CEO DIVINE as head of culture

ATHENS, Ga. /ScoopCloud/ — FormFree® today announced the appointment of former hip-hop/rap recording artist-turned-techpreneur Victor D. Lombard, professionally known as DIVINE, as head of culture. DIVINE is the CEO and founder of Solvent, a fintech focused on financial empowerment for marginalized groups.

Premium Mortgage Corporation taps LenderLogix’s LiteSpeed to power Digital-First Mortgage Borrowing Experience

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, today announced that Rochester, N.Y.-based Premium Mortgage Corporation (Premium Mortgage) is the latest mortgage lender to implement its streamlined point-of-sale (POS) platform LiteSpeed to provide borrowers with a white-labeled, digitally-driven mortgage application experience.

Peak Residential Lending Builds Digital-First Mortgage Borrowing Experience Using LenderLogix Product Suite

BUFFALO, N.Y. /ScoopCloud/ — LenderLogix, a leading provider of mortgage automation software and application programming interfaces (APIs), today announced Peak Residential Lending has implemented its complete application suite – LiteSpeed, QuickQual and Fee Chaser – into its existing tech stack to power a digital-first borrower experience.

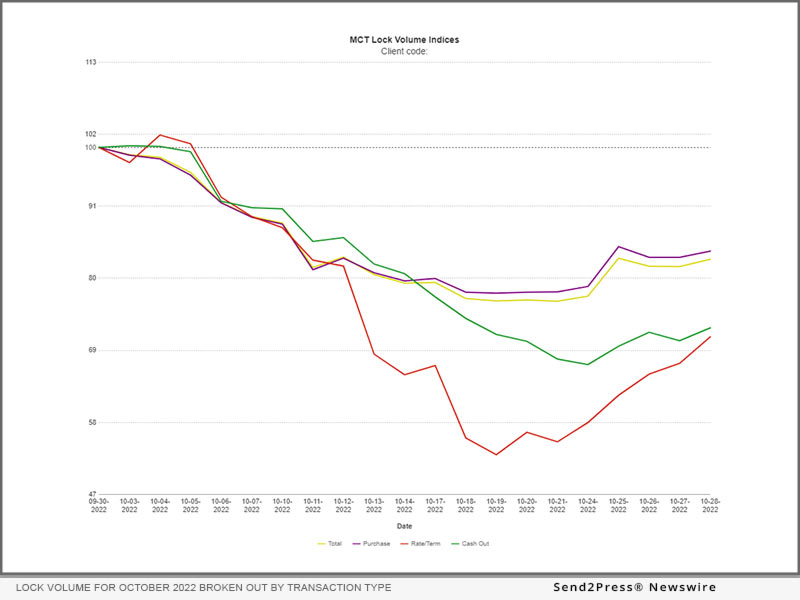

MCTlive! Lock Volume Indices: October 2022 Data

SAN DIEGO, Calif. /ScoopCloud/ — MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for October 2022. MCT Data represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels.

FormFree names former ICE finance executive Patrick Rutherford as CFO to fuel its next stage in company growth

ATHENS, Ga. /ScoopCloud/ — FormFree today announced that it has appointed Patrick Rutherford, former finance executive at Intercontinental Exchange (NYSE: ICE), as chief financial officer (CFO). In his new role at FormFree, Rutherford will lead the organization’s finance, accounting and compliance functions.

National Bankers Association Endorses Promontory MortgagePath for Mortgage Fulfillment Services and POS Technology

DANBURY, Conn. /ScoopCloud/ — Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC today announced the National Bankers Association (NBA) has endorsed its mortgage fulfillment services and proprietary point-of-sale technology, Borrower Wallet®.

IDS expands mortgage eClosing platform with addition of eVault

SALT LAKE CITY, Utah /ScoopCloud/ — Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that it has released its eVault, expanding the capabilities of its eClosing platform, Solitude Solution. With the addition of the eVault to Solitude Solution, lenders now have the ability to deliver documents, including eNotes, to partners though Mortgage Electronic Registration Systems, Inc. (MERS) eRegistry.

Promontory MortgagePath Founder and CEO Eugene Ludwig honored as top technology executive by Northern Virginia Technology Council

DANBURY, Conn. /ScoopCloud/ — Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today its Founder and CEO Gene Ludwig was named one of the top technology executives by the Northern Virginia Technology Council (NVTC) as part of its annual NVTC Tech 100 awards.

Promontory MortgagePath Promotes Dean McCall into its C-Suite as Chief Information Officer

DANBURY, Conn. /ScoopCloud/ — Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today it has promoted Dean McCall from managing director of development operations and data to chief information officer (CIO).

Fintech provider Promontory MortgagePath’s digital mortgage and fulfillment solutions receive renewed ABA endorsement

DANBURY, Conn. /ScoopCloud/ — Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced the renewal of its product endorsement by the American Bankers Association (ABA). Promontory MortgagePath combines extensive mortgage operations and compliance expertise with industry-leading mortgage technology to provide efficient, cost-effective mortgage processing and fulfillment services to lenders of all sizes.

FormFree integration with OpenClose enhances lending experience with quick and easy borrower-permissioned data verification

ATHENS, Ga. /ScoopCloud/ — FormFree® Founder and CEO Brent Chandler today announced the availability of its AccountChek® financial data verification service within OpenClose®, the leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders. The integration embeds AccountChek into OpenClose’s ConsumerAssist(tm) Enterprise POS and LenderAssist(tm) LOS, giving borrowers the freedom to electronically permission verification data with ease when applying for a mortgage loan.

Mortgage Coach and HomeBinder partner to engage homeowners in actively managing home financing across the homeownership lifecycle

IRVINE, Calif. /ScoopCloud/ — Mortgage Coach, the mortgage industry’s leading platform enabling lenders to create digital and accurate home loan options for consumers, today announced an integration with HomeBinder, a centralized home management platform that keeps homeowners connected with mortgage lenders, Realtors and other authorized professionals.

Global DMS’ EVO® enhances efficiency and mobility with Amazon’s Alexa Voice Command Interface

LANSDALE, Pa. /ScoopCloud/ — Global DMS, the leading provider of cloud-based real estate appraisal management software, recently announced that its next-generation EVO platform is now voice-enabled, providing lenders access to key functionality and up to the minute information of their entire pipeline with Amazon’s Alexa voice control – making EVO the first and only appraisal management software to provide this capability in the mortgage industry.

SimpleNexus rounds out its Nexus Closing eMortgage solution with DocMagic’s eVault and eNote technologies, enabling fully digital loan closings

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced the integration of its Nexus Closing™ eMortgage solution with DocMagic’s eVault and eNote technologies. The integration enables automated generation of an eNote with a tamper-evident seal and delivers the eNote to a secure eVault for delivery to the MERS® eRegistry.

Promontory MortgagePath Promotes Bryan DeShasier to Chief Administrative Officer, Adds Helen Placente as Managing Director of National Credit Operations

DANBURY, Conn. /ScoopCloud/ — Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced two key staffing changes expanding the strength of its executive team. Bryan DeShasier has been promoted to Chief Administrative Officer (CAO), and Helen Placente has been hired as Managing Director of National Credit Operations.

SimpleNexus is certified as eClosing solution provider by Fannie Mae and Freddie Mac

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, is now a Fannie Mae- and Freddie Mac-reviewed eClosing solution provider. The designation affirms that SimpleNexus’ Nexus Closing™ eMortgage solution meets both GSEs’ technical requirements for eClosing, eNote and eVault functionality and has been tested for compatibility with the GSEs’ respective eNote delivery systems.

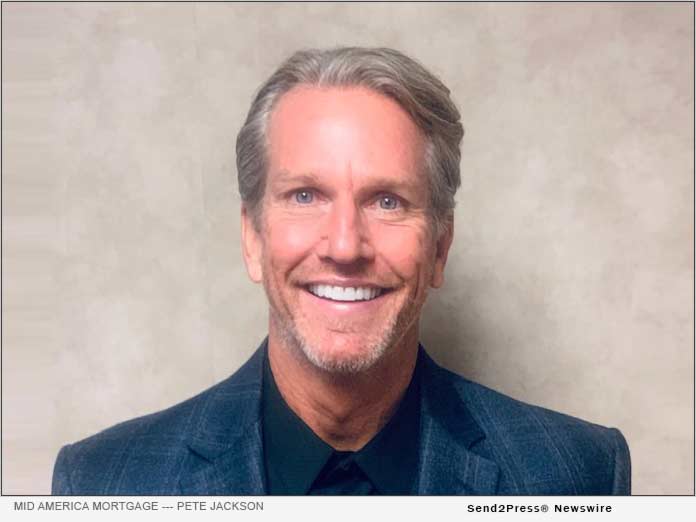

Mid America Mortgage Adds Pete Jackson as Divisional Director for Wholesale/Non-Delegated Correspondent Channel, Tim Frohock as Regional Director

ADDISON, Texas /ScoopCloud/ — Mid America Mortgage, Inc. (Mid America) announced today that Pete Jackson has joined the company as a divisional director and Tim Frohock as a regional director. With more than 30 years of wholesale and correspondent lending experience, Jackson and Frohock will play a critical role in the continued growth and success of Mid America’s wholesale/non-delegated correspondent lending channel.

Promontory MortgagePath COO Debora Aydelotte Earns Top Female Industry Leadership Honors from HousingWire and Mortgage Banker Magazine

DANBURY, Conn. /ScoopCloud/ — Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced Chief Operating Officer Debora Aydelotte has been recognized by HousingWire and Mortgage Banker Magazine for her leadership contributions to the mortgage industry. Aydelotte has been named one of HousingWire’s 2021 Women of Influence and is among Mortgage Banker Magazine’s 2021 Powerful Women in Mortgage Banking.

SimpleNexus expands C-suite under leadership of Cathleen Schreiner Gates

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced new executive appointments in operations, revenue generation and customer success.

Mid America Mortgage Securitizes Its First Ginnie Mae eNote with eCustodian Wilmington Trust

ADDISON, Texas /ScoopCloud/ — Mid America Mortgage, Inc. (Mid America) announced today that the company has completed its first Ginnie Mae eNote transaction with Wilmington Trust, an approved and active eCustodian under Ginnie Mae’s Digital Collateral Initiative. Having announced its first eNote transaction in August 2016, this represents the next step in Mid America’s ongoing digital mortgage adoption efforts across its retail, wholesale and correspondent lending channels.

Provident Funding Partners with Lender Price

PASADENA, Calif. /ScoopCloud/ — Lender Price, a provider of mortgage loan pricing and origination technology, announced today that Provident Funding has joined the Lender Price Marketplace. Provident Funding has been committed to the wholesale channel since inception in 1992. The Lender Price Marketplace user base has doubled over the past 12 months with more than 5,700 brokers.

SimpleNexus Welcomes Andria Lightfoot as Vice President of Professional Services

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced the hire of mortgage industry veteran, Andria Lightfoot, PMP, CSM, as vice president of professional services.

Promontory MortgagePath Appoints Savita Ilango as Chief Financial Officer

DANBURY, Conn. /ScoopCloud/ — Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and tech-driven fulfillment solutions, announced today it has hired Savita Ilango as chief financial officer. A financial industry veteran, Ilango brings unique perspectives for helping Promontory MortgagePath continue both on its growth trajectory and toward achieving its mission of changing the way lenders approach their mortgage business.

SimpleNexus accelerates momentum in 2020 with one of eight U.S. mortgage loans passing through its homeownership platform

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading homeownership platform for loan officers (LOs), borrowers, real estate agents and settlement agents, today announced accelerated momentum in 2020 marked by expansive market growth and product innovation.

UniversalCIS Announces Acquisition of SharperLending

PHILADELPHIA, Pa. /ScoopCloud/ — UniversalCIS, a market leader in technology and solutions to the mortgage industry, is pleased to announce the acquisition of mortgage technology provider SharperLending. The SharperLending transaction, which follows the merger of Universal Credit, CIS Credit Solutions, and Avantus, provides further enhancements to the technology platform for UniversalCIS.

ReverseVision Announces New CEO Joe Langner

SAN DIEGO, Calif. /ScoopCloud/ — ReverseVision®, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced the promotion of its president Joe Langner to president and chief executive officer. In this expanded role, Langner will lead ReverseVision’s mission to empower America’s seniors to use home equity as part of retirement finance.

SimpleNexus ROI Calculator lets mortgage lenders accurately model the financial and operational benefits of investing in digital mortgage technology

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers, real estate agents and settlement agents, today announced the availability of the SimpleNexus ROI Calculator.

Promontory MortgagePath Launches Initiative to Help Minority-Owned Financial Institutions Expand Mortgage Credit Access to Underserved Communities

DANBURY, Conn. /ScoopCloud/ — Promontory MortgagePath LLC today launched its initiative to support minority depository institutions’ (MDIs) efforts to expand access to credit and homeownership in underserved communities. Through this initiative, Promontory MortgagePath, a leading provider of comprehensive digital mortgage and tech-driven fulfillment solutions, will partner with minority-owned banks and credit unions.

MCT’s Business Intelligence Platform Gives Lenders Competitive Advantage with Actionable Insights and Data

SAN DIEGO, Calif. /ScoopCloud/ — MCT announced the upcoming launch of their Business Intelligence Platform, a powerful web-based analytics platform designed to empower lenders to understand the market, optimize their loan sales, and improve performance relative to their peers. The platform will be officially released and dem

SimpleNexus Team Members enables mortgage lenders to fine-tune digital mortgage workflows, file permissions at the user level

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers, real estate agents and settlement agents, today announced the release of SimpleNexus Team Members, a feature that allows lenders to work more efficiently by managing loan file permissions and employee workflows based on assigned user roles.

DocMagic and VirPack Announce Integration of Platforms

TORRANCE, Calif. /ScoopCloud/ — DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that that it has integrated its eSign platform with VirPack to facilitate the seamless exchange of loan files and docs for compliant eSigning through DocMagic’s eSign platform.

VirPack and Mortgage Builder Announce Integration Built to Streamline the Digital Mortgage Process

MCLEAN, Va. /ScoopCloud/ — VirPack is pleased to announce a new partnership with Mortgage Builder, a Constellation Mortgage Solution Company and full loan lifecycle solution. This new integration will provide Mortgage Builder customers advanced workflow and document management capabilities, including optical character recognition that automates document recognition and data extraction to easily determine if data extracted from critical loan documents matches loan data in Mortgage Builder.

SimpleNexus Taps Board Member Cathleen Schreiner Gates as Company President

LEHI, Utah /ScoopCloud/ — SimpleNexus, developer of the leading digital mortgage platform for loan officers, borrowers, real estate agents and settlement agents, today announced the appointment of Board Member Cathleen Schreiner Gates as company president.

Blue Sage and FormFree Partner to Streamline Lending Process with AccountChek Automated Asset Verification Integration

ATHENS, Ga. /ScoopCloud/ — FormFree today announced the availability of its AccountChek automated asset verification service within Blue Sage’s cloud-based digital mortgage lending platform. The integration makes it possible for borrowers to verify assets with AccountChek through the Blue Sage Borrower Portal.