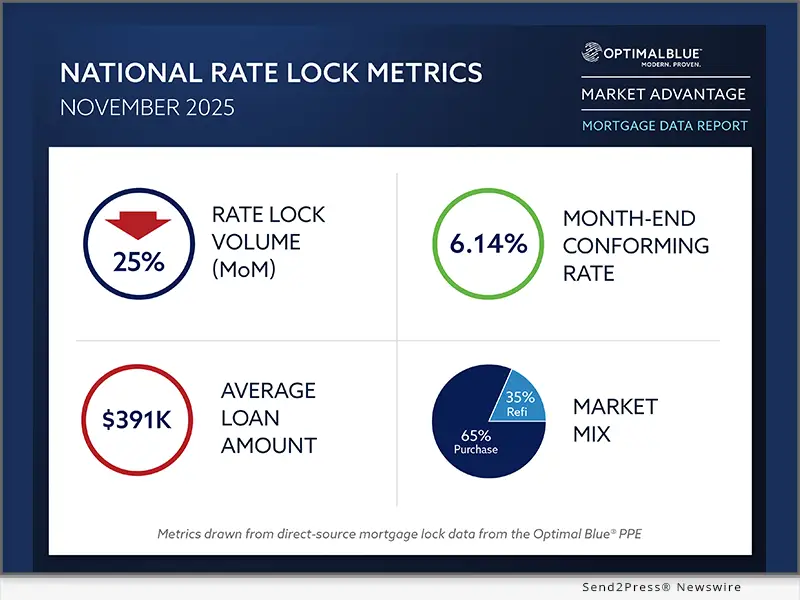

Optimal Blue report: Lock volume posts strongest November since 2021

PLANO, Texas, Dec. 10, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its November 2025 Market Advantage mortgage data report, which found that total mortgage rate-lock activity declined with normal late fall seasonality, yet still marked the strongest November in four years. Total lock volume fell 25% month over month (MoM) from October but remained up 17% year over year (YoY), buoyed by historically strong refinance demand and mortgage rates holding near 6%.

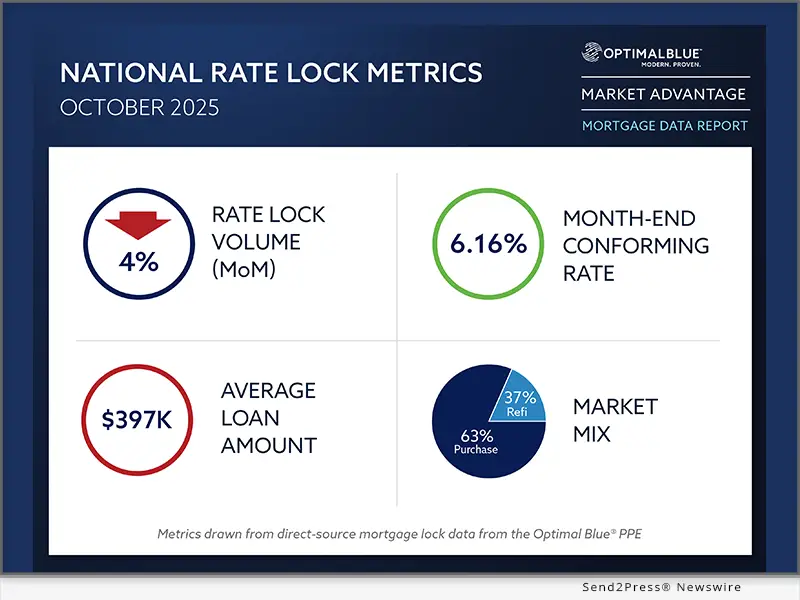

Optimal Blue report: October lock volume holds second-highest level in three years

PLANO, Texas, Nov. 11, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its October 2025 Market Advantage mortgage data report, showing that rate-lock activity remained strong despite seasonal cooling and continued to outpace last year’s levels. Total lock volume fell 4.2% month over month (MoM) from September’s peak but was still up 18% year over year (YoY) as borrowers responded to improving affordability and narrower rate spreads.

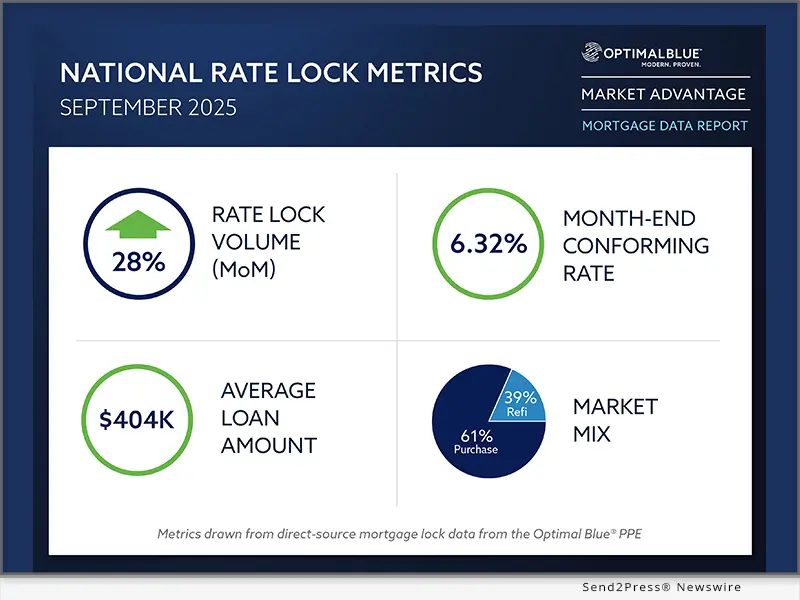

Optimal Blue report: Rate rally drives 28% surge in September lock volumes

PLANO, Texas, Oct. 14, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its September 2025 Market Advantage mortgage data report, which showed a sharp increase in rate-lock activity as mortgage rates fell throughout the month to their lowest levels in nearly a year. Total lock volume rose 28% month over month (MoM), led by a surge in refinance lending as borrowers seized on the opportunity to lower monthly payments. Purchases also climbed 6% MoM, outperforming typical seasonal trends as improved affordability brought more buyers into the market.

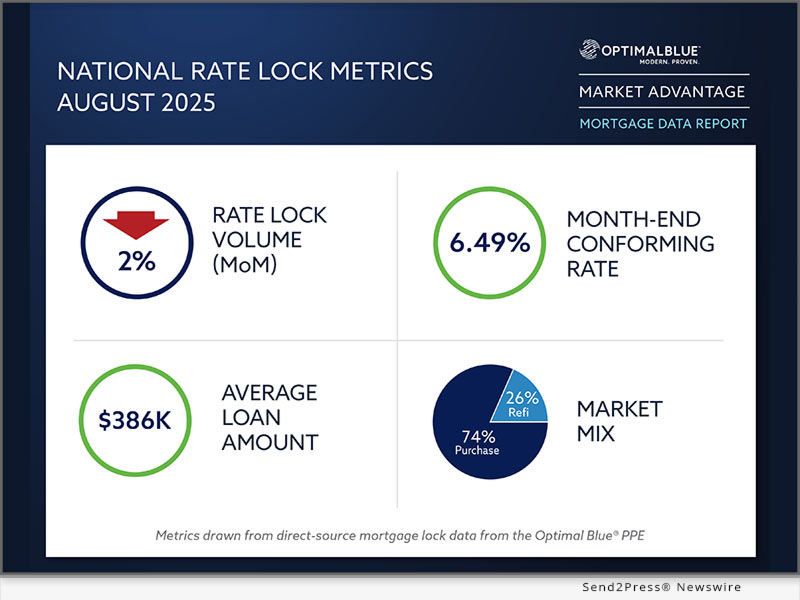

Refinances surge nearly 70% as purchase activity falls 10% in August

PLANO, Texas, Sept. 10, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its August 2025 Market Advantage mortgage data report, which found a sharp split between purchase and refinance trends as seasonal factors and falling rates reshaped origination activity. Total lock volume dipped about 2% month over month (MoM) as a roughly 10% drop in purchase locks outweighed the strongest month for rate-and-term refinances this year, which surged nearly 70%.

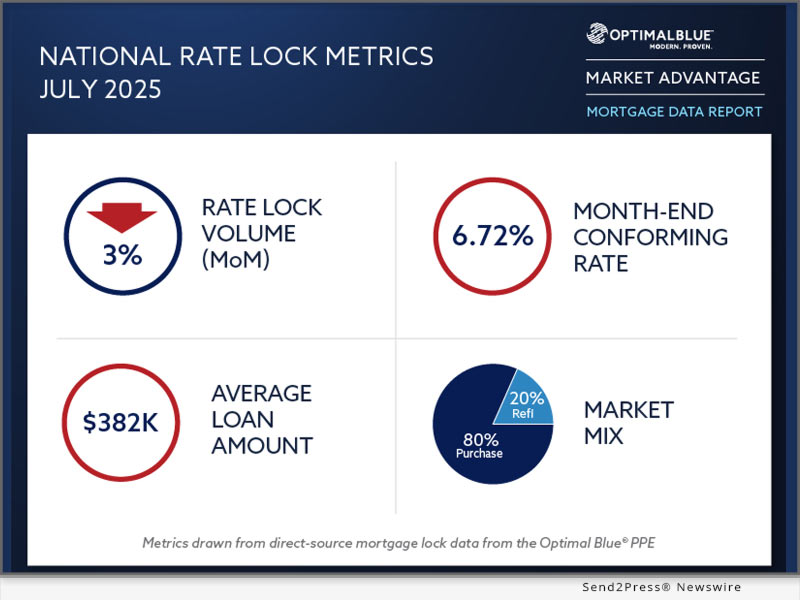

Refinances tick up and non-QM hits record high as purchase activity falls nearly 5% in July

PLANO, Texas, Aug. 12, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its July 2025 Market Advantage mortgage data report, which found a 3% month-over-month (MoM) drop in overall rate lock volume, led by a nearly 5% drop in purchase activity as affordability remained strained. Mortgage rates rose MoM across all loan types.

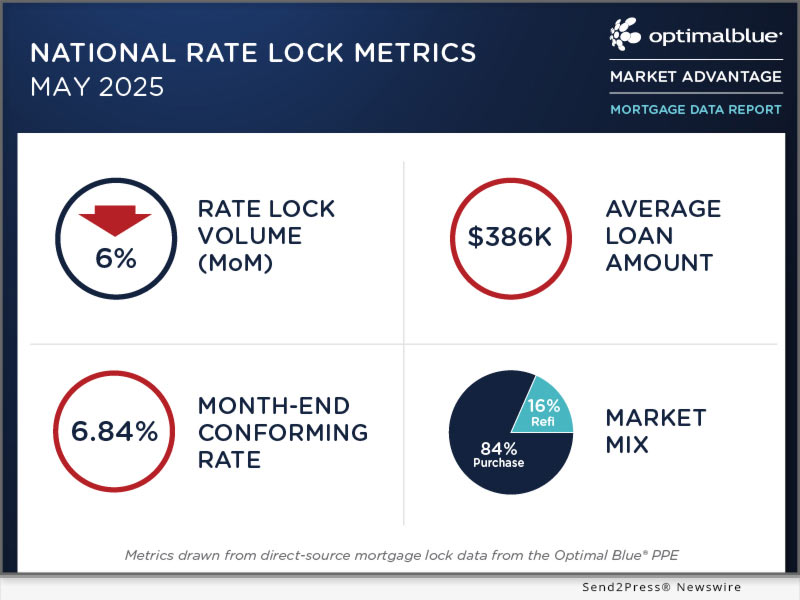

Optimal Blue Releases May Data Findings, Announces Expansion of Monthly Report for More Comprehensive Lender Profitability Insights

PLANO, Texas, June 10, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released the May 2025 edition of its now-expanded Market Advantage mortgage data report, which features newly added borrower profile and capital market datasets for a more comprehensive picture of early-stage mortgage activity and loan profitability. The enhancements come at a critical time for mortgage lenders navigating heightened interest rates, tighter margins, increased volatility and deepening affordability challenges.

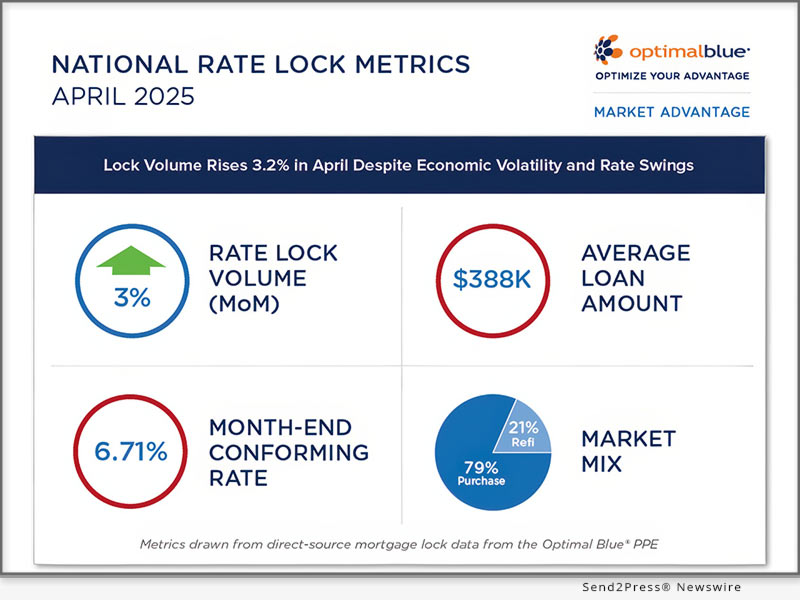

Lock Volume Rises 3.2% in April, Driven by Uptick in FHA Loans, Despite Economic Volatility

PLANO, Texas, May 13, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its April 2025 Market Advantage mortgage data report showing total loan lock volume rose 3.2% month-over-month (MoM) as the spring homebuying season progressed, with purchase locks up 7.5% despite ongoing economic pressures.

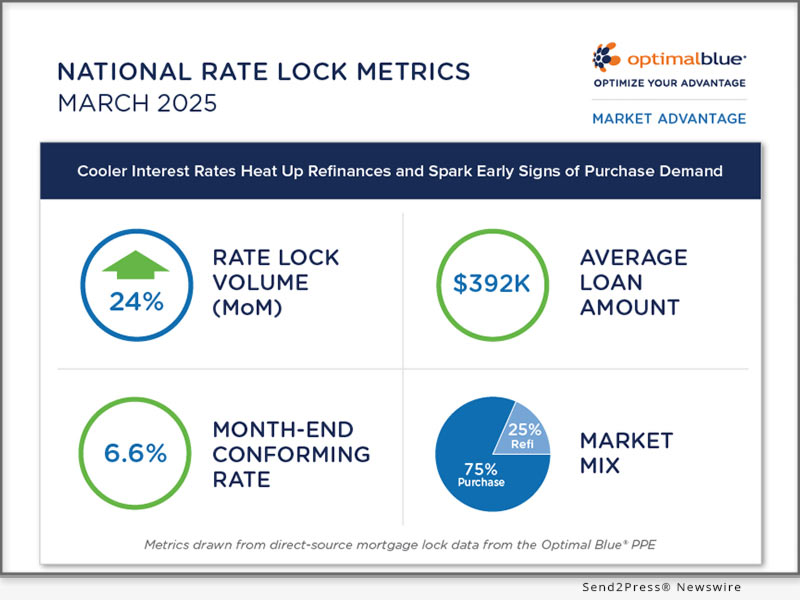

Cooler Interest Rates Heat Up Refinances and Spark Early Signs of Purchase Demand

PLANO, Texas, April 8, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its March 2025 Market Advantage mortgage data report, showing a 24% surge in rate lock volume as early spring buyers returned to the market and homeowners jumped at the chance to refinance into lower rates. While still down 2% on a year-over-year (YoY) basis, purchase volumes were up 21% month-over-month (MoM). Rate-and-term and cash-out refinances jumped 52% and 20% MoM, respectively, together representing 25% of all lock activity.

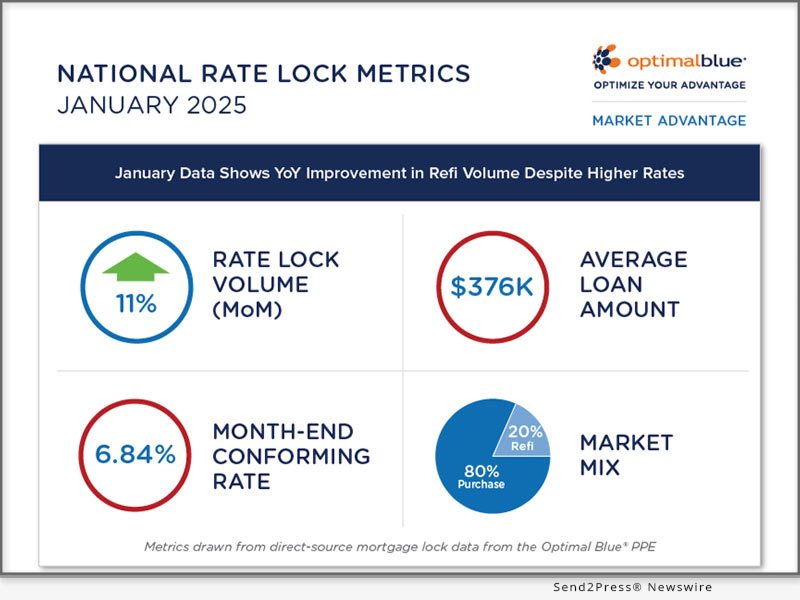

January Mortgage Lock Data Shows Year-Over-Year Improvement in Refinance Volume Despite Higher Rates

PLANO, Texas, Feb. 13, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its January 2025 Market Advantage mortgage data report, revealing a sharp rise in year-over-year (YoY) refinance activity alongside a drop in purchase lock counts. The decline in purchase lock counts marks the lowest January count since Optimal Blue began tracking this data in 2019. Meanwhile, refinance lock volume surged even though the Optimal Blue Mortgage Market Indices (OBMMI) 30-year ticked above 7% for the first time since May.

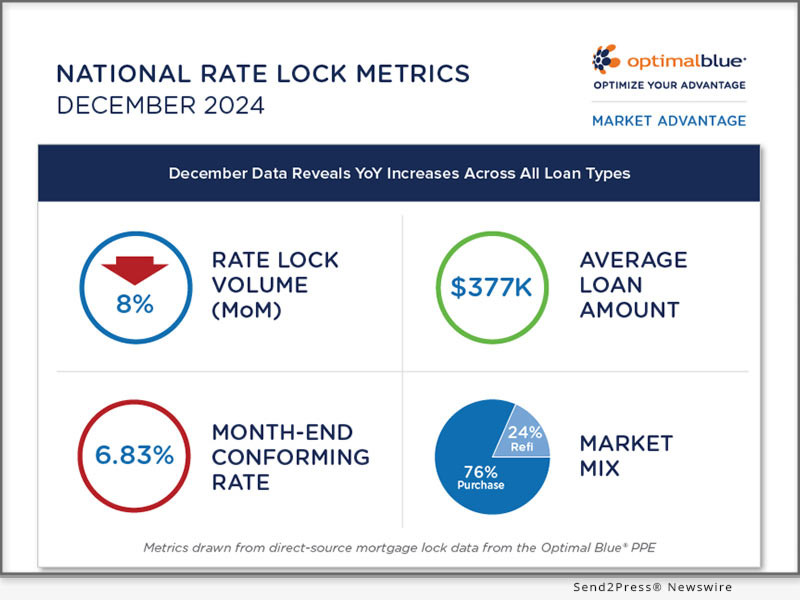

December Mortgage Lock Data Reveals Year-Over-Year Increases Across All Loan Types Despite Seasonal Downturn

PLANO, Texas, Jan. 14, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its December 2024 Market Advantage mortgage data report, showcasing year-over-year (YoY) growth in mortgage activity, even as seasonal trends led to a month-over-month (MoM) decline in rate lock volumes. Overall, December mortgage lock volume was up 26% YoY, driven by an 18% increase in purchase locks, a 43% rise in cash-out refinances, and an 82% jump in rate-and-term refinances.

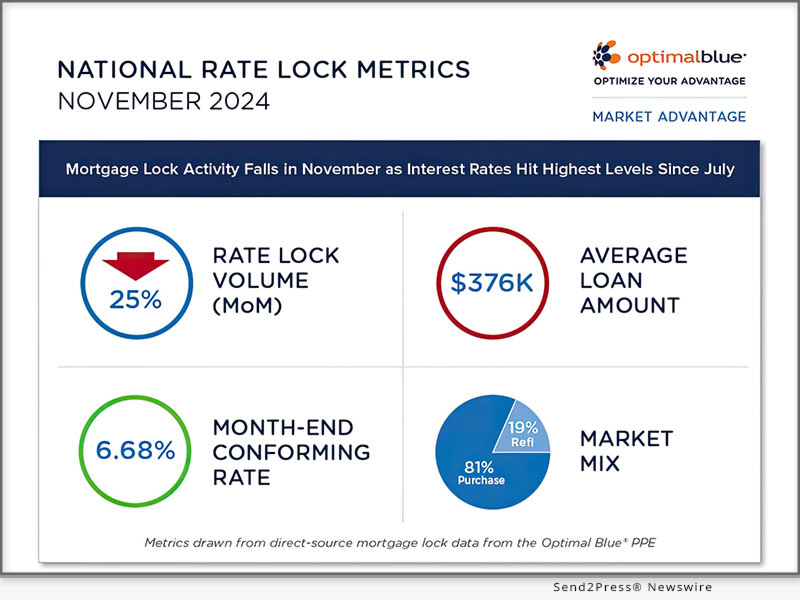

Mortgage Lock Activity Fell in November as Interest Rates Hit Their Highest Levels Since July

PLANO, Texas, Dec. 10, 2024 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its November 2024 Market Advantage mortgage data report, highlighting a 25% decrease in month-over-month (MoM) lock volume as interest rates hit their highest levels since early July, creating headwinds for affordability. Purchase lock volume was down 21% MoM, while cash-out and rate-and-term refinance volumes fell 20% and 50%, respectively.

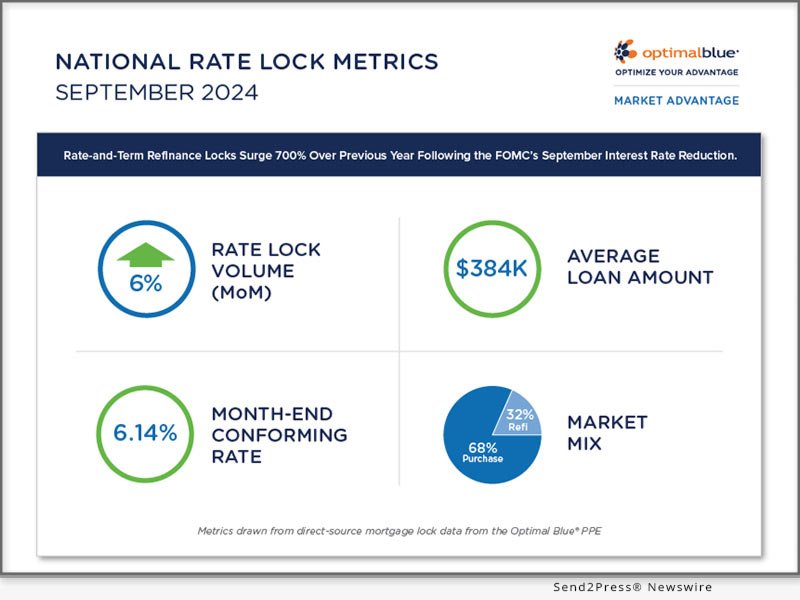

Rate-and-Term Refinance Locks Surge 700% Over Previous Year Following the FOMC’s September Interest Rate Reduction

PLANO, Texas, Oct. 8, 2024 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its September 2024 Market Advantage mortgage data report, which found a 50% month-over-month (MoM) increase in rate-and-term refinance activity as people who purchased homes in recent years jumped at the opportunity to lower their interest rates and mortgage payments. While the Federal Open Market Committee (FOMC) lowered its target federal funds rate by 50 bps on Sept. 18, the market had already priced in a portion of the rate reduction, leading to a full month of increased refinance activity in September.

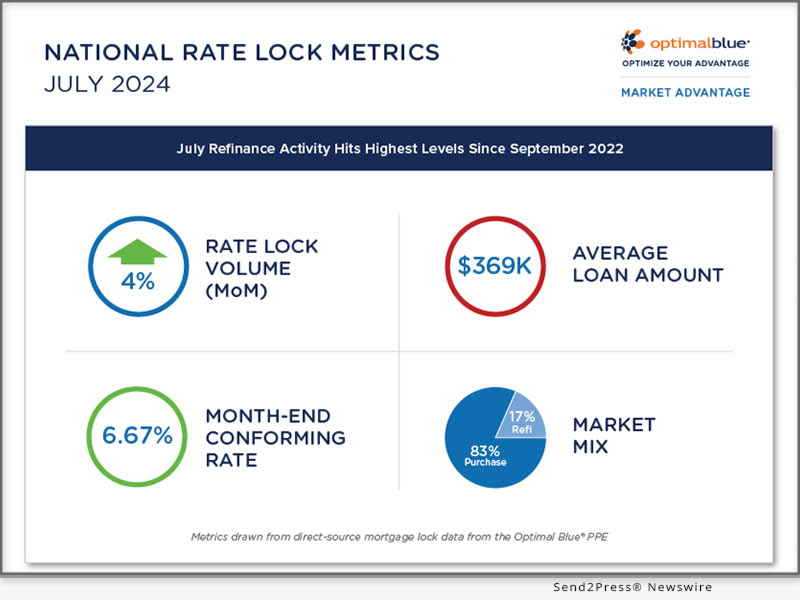

July Refinance Activity Hits Highest Levels Since September 2022

PLANO, Texas /ScoopCloud/ — Optimal Blue today released its July 2024 Market Advantage mortgage data report, which revealed that mortgage refinance demand surged to levels not seen since September 2022 amid softening interest rates. The lower interest rates seen in July also coaxed increased purchase activity, which, combined with greater refi activity, drove a 3.5% month-over-month (MoM) increase in mortgage rate lock volumes.

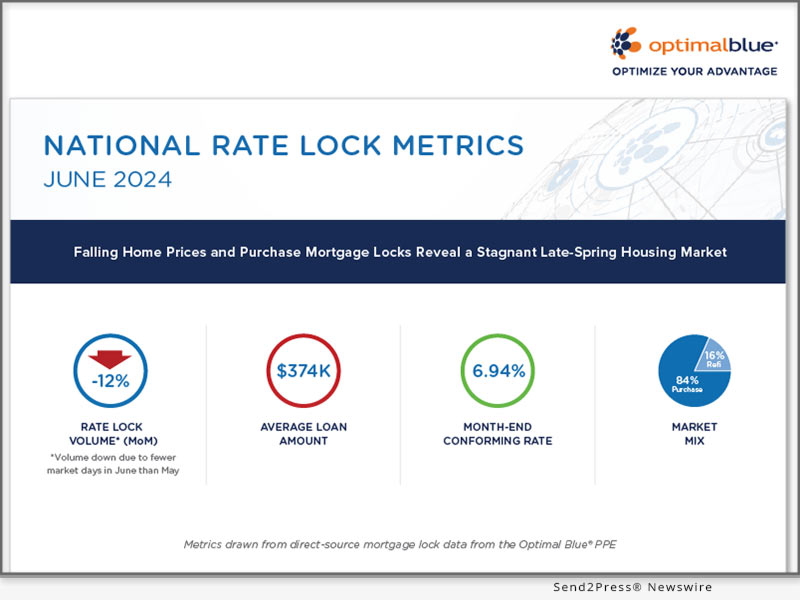

Falling Home Prices and Purchase Mortgage Locks Reveal a Stagnant Late-Spring Housing Market

PLANO, Texas /ScoopCloud/ — Optimal Blue today released its June 2024 Market Advantage mortgage data report, which revealed a stagnant late-spring housing market as home prices dropped for the first time in 2024 and purchase lock counts fell 8% over the previous year. All mortgage lock figures in this news release have been controlled for fewer market days in June.

Mortgage Interest Rate Sensitivity Triggers 25% Spike in May Rate-and-Term Refinance Activity

PLANO, Texas /ScoopCloud/ — Optimal Blue today released its May 2024 Market Advantage mortgage data report, which revealed a 25.6% month-over-month (MoM) spike in rate-and-term mortgage refinances. The spike was a response to a modest drop in the Optimal Blue Mortgage Market Indices (OBMMI) 30-year conforming rate, which ended the month at 7.02%.