Dark Matter Technologies enables secure AI agents inside the Empower LOS for regulated lending

JACKSONVILLE, Fla., Feb. 25, 2026 (SEND2PRESS NEWSWIRE) — Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced the launch of a new capability on the Dark Matter Developer Platform, enabling lenders to use AI agents securely within the regulated mortgage environment.

Friday Harbor introduces dynamic pre-underwriting to help LOs structure deals that qualify and close

SEATTLE, Wash., Feb. 24, 2026 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI pre-underwriting platform that helps loan officers assemble complete and compliant loan files in real time, today announced the launch of Income and Asset Sandbox, a new set of capabilities that allows lending teams to structure income and asset decisions in real time without committing changes prematurely or stepping outside program guidelines. The capabilities are designed to help loan officers structure deals that qualify and close earlier in the origination process.

Industry-first AI/ML-powered forecasting tool headlines extensive lineup of mortgage capital markets innovations unveiled at 2026 Optimal Blue Summit

PLANO, Texas, Feb. 24, 2026 (SEND2PRESS NEWSWIRE) — Optimal Blue today announced Virtual Economist, the first on-demand forecasting tool for mortgage capital markets leaders powered by artificial intelligence and machine learning (AI/ML), as the centerpiece of nine platform advancements unveiled at the company’s 2026 Summit. Together, the innovations further unify the capital markets profitability experience by connecting forecasting, pricing, hedging, competitive benchmarking and workflow execution within a single, end-to-end platform.

OCCU selects Floify to support scalable, member-centric lending

BOULDER, Colo., Feb. 17, 2026 (SEND2PRESS NEWSWIRE) — Floify, the mortgage industry’s leading point-of-sale (POS) solution, today announced that OCCU has selected Floify to support its next phase of member-centric lending and long-term growth. OCCU is a member-owned, not-for-profit credit union based in Eugene, Oregon, with more than 284,000 members.

Friday Harbor adds Fannie Mae’s Income Calculator to its AI Originator Assistant

SEATTLE, Wash., Jan. 6, 2026 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the integration of its AI Originator Assistant with Fannie Mae’s Income Calculator. The new connection enables lenders to instantly calculate qualifying income for borrowers with self-employment or rental income and gain enforcement relief from representations and warranties on the income calculation for conventional loans.

TMC to host inaugural ACT Technology Summit focused on mortgage technology and AI

SAN DIEGO, Calif., Dec. 22, 2025 (SEND2PRESS NEWSWIRE) — The Mortgage Collaborative (TMC), the nation’s leading independent cooperative network for mortgage lenders, today announced it will host the inaugural ACT Technology Summit, short for Accelerator and Collaborative Transformation, a two-day standalone mortgage technology competition and showcase Aug. 12-13 at The Highlands Hotel in Dallas.

LenderLogix expands LiteSpeed POS with built-in AI-powered agent for mortgage loan officers

BUFFALO, N.Y., Nov. 10, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced it has launched AI Sidekick, an artificial intelligence (AI) feature built into the LiteSpeed point-of-sale (POS) platform. AI Sidekick supports loan officers (LOs) with simple tools to instantly review loan files, efficiently update document needs lists and rapidly identify missing data, reducing loan processing times by up to 40%.

Friday Harbor adds appraisal underwriting to its AI Originator Assistant

SEATTLE, Wash., Nov. 6, 2025 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced that its AI Originator Assistant now performs collateral analysis alongside credit, income and asset reviews. The enhancement enables lenders to underwrite appraisals and appraisal-related documents with the same precision and consistency the platform already delivers for other loan file components.

Floify launches Dynamic AI: embedded intelligence that elevates the mortgage POS experience

BOULDER, Colo., Oct. 14, 2025 (SEND2PRESS NEWSWIRE) — Floify, the mortgage industry’s leading point-of-sale (POS) solution, today announced the launch of Dynamic AI, a new capability that reimagines the mortgage application process by moving document collection and AI-driven data extraction to the very beginning of the process.

Friday Harbor puts lenders in control with underwriting overlays in its AI Originator Assistant

SEATTLE, Wash., Oct. 13, 2025 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced that its AI Originator Assistant can now evaluate loan files against not only baseline program guidelines, but also the lender and investor overlays that ultimately shape salability and risk. By embedding these requirements directly into the workflow of frontline originators, the platform gives lenders greater control over credit quality and secondary market execution.

Navy Federal Credit Union renews its contract with Dark Matter Technologies to serve its growing membership

JACKSONVILLE, Fla., Sept. 30, 2025 (SEND2PRESS NEWSWIRE) — Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced a renewed multi-year partnership with Navy Federal Credit Union. The agreement reinforces the credit union’s strategic focus on digital transformation and elevating the member lending experience.

ACES Quality Management Launches ACES Intelligence™, Redefining Mortgage and Financial Services Quality Control with AI

DENVER, Colo., Sept. 24, 2025 (SEND2PRESS NEWSWIRE) — ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the launch of ACES Intelligence, the industry’s first and only AI-powered features for quality control (QC). ACES Intelligence helps ACES customers improve quality, speed and efficiency by enhancing loan reviews, selection and compliance.

Friday Harbor joins Community Home Lenders of America as affiliate member

SEATTLE, Wash., Sept. 10, 2025 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, has joined the Community Home Lenders of America (CHLA) as an affiliate member. Friday Harbor will serve as an expert adviser to CHLA’s lender members on the use of artificial intelligence in housing finance.

DocMagic One launches to unify mortgage production under a single, AI-powered platform

TORRANCE, Calif., Sep. 10, 2025 (SEND2PRESS NEWSWIRE) — DocMagic, Inc. today announced the launch of DocMagic® One, a new platform for lenders that eliminates the inefficiencies of juggling multiple systems by bringing every critical loan manufacturing step into a single, intuitive platform. Document preparation, compliance checks, collaboration between borrowers, title agents and settlement agents, and closing coordination all happen in one place. Role-based permissions and organizational hierarchies keep tasks moving without bottlenecks.

Friday Harbor announces integration with ICE Mortgage Technology’s Encompass

SEATTLE, Wash., Sept. 3, 2025 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced its new integration with the Encompass® loan origination system (LOS) from ICE Mortgage Technology, part of Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure. Built using ICE’s latest Developer Connect API framework for mortgage technology, the integration enables seamless use of Friday Harbor within the Encompass environment.

Friday Harbor adds Chris Simms, Gregory Buehler to leadership team to accelerate AI-powered mortgage origination

SEATTLE, Wash., July 24, 2025 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, announced two strategic hires today: Chris Simms has joined as head of strategic partnerships, and Gregory Buehler has joined as founding product manager. They bring over 35 years of combined experience in mortgage lending, product strategy and technology innovation.

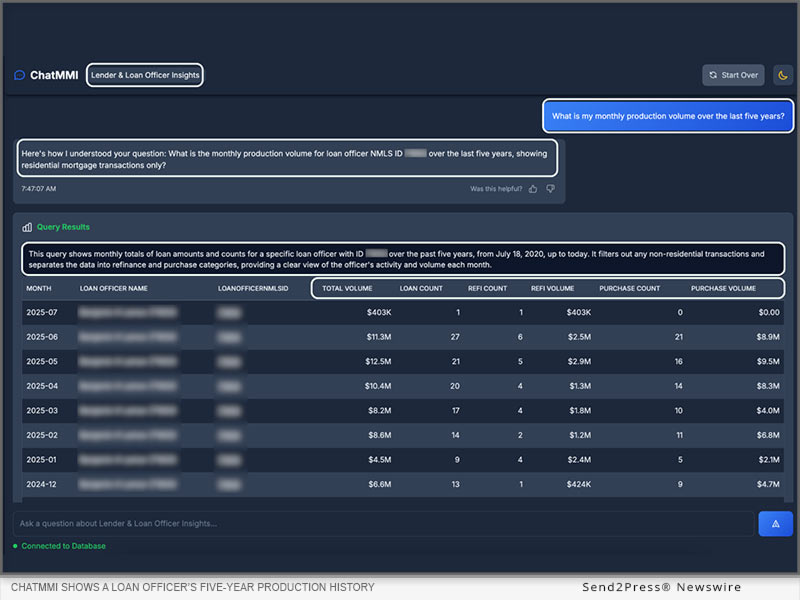

MMI Unveils ChatMMI: Mortgage Intelligence, One Question Away

SALT LAKE CITY, Utah, July 21, 2025 (SEND2PRESS NEWSWIRE) — Mobility Market Intelligence (MMI), the original pioneer in mortgage market intelligence, today announced the launch of ChatMMI™ – the industry’s first conversational AI interface built specifically for lenders, recruiters, and mortgage professionals. Founded in 2008, MMI has spent nearly two decades building the industry’s most comprehensive mortgage data solution.

Friday Harbor unveils AI-powered condition engine to deliver faster, cleaner, audit-ready mortgage files

SEATTLE, Wash., May 29, 2025 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the launch of a retooled condition engine that automatically generates actionable underwriting conditions based on borrower source documents and loan guidelines.

Optimal Blue Releases Executive-Level AI Insights Tool, Ask Obi, to Clients

PLANO, Texas, May 19, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today announced that Ask Obi, an AI-powered assistant designed to help mortgage lending executives extract real-time insights from across Optimal Blue’s capital markets platform, is now generally available to all PPE clients. Introduced at the company’s inaugural user conference in February and refined through beta testing with select clients, Ask Obi provides executives with fast answers to complex profitability questions at no additional cost.

Optimal Blue Brings AI-Powered Originator Assistant to Market, Helping Originators Present Best Possible Loan Options to Borrowers

PLANO, Texas, May 1, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today announced the general availability of Originator Assistant, a powerful addition to the Optimal Blue PPE. Leveraging generative AI, Originator Assistant eliminates human bias in the loan structuring process and helps originators identify all options for a borrower, providing more ways to help consumers realize the American dream of homeownership.

Friday Harbor raises $6M to help community mortgage lenders match the speed and efficiency of industry giants

SEATTLE, Wash., April 15, 2025 (SEND2PRESS NEWSWIRE) — Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the completion of a $6 million seed round. The round was led by Abstract Ventures, a San Francisco-based venture firm with $1.5 billion in assets under management and a track record of backing breakout companies including Rippling, xAI, Hebbia, Brigit and Hippo (NYSE: HIPO) and Mischief, an early-stage VC fund co-founded by Plaid CEO Zach Perret.

Optimal Blue Introduces Seven Major Innovations at Its Inaugural User Summit in San Diego

SAN DIEGO, Calif., Feb. 4, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today unveiled a series of new products and features, alongside its major Ask Obi AI assistant announcement, at its Summit user conference in San Diego. These innovation announcements underscore the company’s commitment to delivering high-impact solutions, at no additional cost, that tackle real-world challenges and help lenders maximize profitability.

Optimal Blue Announces Ask Obi, an AI Assistant to Provide Mortgage Lending Executives With Real-Time Business Insights

SAN DIEGO, Calif., Feb. 4, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today announced Ask Obi, an AI assistant designed to provide mortgage lending executives with instant, actionable insights from their Optimal Blue products and data. Unveiled during Optimal Blue’s inaugural Summit user conference in San Diego, Ask Obi gives lenders the power to view their operations holistically with data aggregation across Optimal Blue’s comprehensive capital markets platform.

Optimal Blue Announces Three Major Product Releases, Continuing Streak of Aggressive Product Innovation and No-Cost Feature Additions

PLANO, Texas, Oct. 28, 2024 (SEND2PRESS NEWSWIRE) — Optimal Blue today announced three major product releases: the expansion of its AI assistant suite, the introduction of Scenario Optimizer, and the free availability of Investor Pricing Insight to investor clients. These product updates build on the company’s commitment to rapidly delivering high-impact solutions that tackle real-world challenges while helping clients maximize profitability.

Optimal Blue Launches New Generative AI Assistant Capabilities

PLANO, Texas /ScoopCloud/ — Optimal Blue today announced the delivery of generative AI capabilities centered on helping lenders maximize profitability on every loan transaction. Through direct engagement with its thousands of clients, the company has begun delivering generative AI capabilities built for secondary-market-specific use cases and purposefully designed to solve the real-world challenges that mortgage lenders face.