Cloudvirga Adds Digital Mortgage Integration with Leading Mortgage Insurance Provider Radian

IRVINE, Calif. /ScoopCloud/ — Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(R), has partnered with Radian Guaranty, a subsidiary of Radian Group (NYSE: RDN), to deliver instant and accurate mortgage insurance (MI) rate quotes and streamline the ordering of MI certificates for lenders.

MCT’s Bid Auction Manager (BAM) Technology Automates Tri-Party Agreement for Investors’ Bid Tape AOT Loan Sale Executions

SAN DIEGO, Calif. /ScoopCloud/ — Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced automation of the Tri-Party Agreement required between lenders, investors, and broker dealers during Assignment Of Trade (AOT) transactions in the secondary market. The functionality is built into MCT’s Bid Auction Manager(TM) (BAM) bid tape management and best execution platform.

NotaryCam Applauds Treasury Recommendations to Remove Barriers to Remote Online Notarization and ‘Fully Digital Mortgage’

NEWPORT BEACH, Calif. /ScoopCloud/ — Rick Triola, founder and CEO of the industry’s most popular remote online notarization solution, NotaryCam, calls the Department of Treasury’s recommendations in its July 31 report to the President: A Financial System That Creates Economic Opportunities: Nonbank Financials, Fintech, and Innovation “a cure to the persistent drags on real estate transactions that have prevented the consumer from experiencing the benefits now possible with digital technologies.”

Lori Brewer of LBA Ware Honored as a HousingWire Woman of Influence

MACON, Ga. /ScoopCloud/ — Leading provider of automated compensation software and systems integration solutions for mortgage lenders LBA Ware(TM) today announced that its CEO and founder Lori Brewer has been honored by HousingWire (HW) magazine as one of the publication’s 2018 Women of Influence.

HousingWire Magazine Honors TRK Connection CEO Teri Sundh

SALT LAKE CITY, Utah /ScoopCloud/ — TRK Connection, a leading provider of mortgage quality control and origination management solutions, announced today that CEO Teri Sundh has been named to HousingWire magazine’s 2018 Women of Influence. Sundh was recently recognized by Mortgage Professional America magazine on their list of Elite Women in Mortgage.

Simplifile’s Toni Carroll Named a Woman of Influence by HousingWire Magazine

PROVO, Utah /ScoopCloud/ — Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that National Settlement Account Manager Toni Carroll has been recognized by HousingWire (HW) on its list of 2018 Women of Influence.

Beckie Santos of IDS Honored as a 2018 Women of Influence by HousingWire

SALT LAKE CITY, Utah /ScoopCloud/ — Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that New Product Development Manager Beckie Santos has been recognized by HousingWire (HW) magazine in its list of 2018 Women of Influence.

Cloudvirga SVP of Product Management Josephine Yen Honored by HousingWire as a 2018 Women of Influence

IRVINE, Calif. /ScoopCloud/ — Cloudvirga(TM), a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(R), today announced that Josephine Yen, its senior vice president of product management, has been named to HousingWire’s 2018 Women of Influence list.

Cloudvirga’s Josephine Yen Named to MPA Magazine’s 2018 Elite Women in Mortgage

IRVINE, Calif. /ScoopCloud/ — Cloudvirga, a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform, today announced that senior vice president of product management Josephine Yen has been named one of Mortgage Professional America magazine’s 2018 Elite Women in Mortgage.

LBA Ware CEO and Founder Lori Brewer Named to MPA’s Elite Women in Mortgage Two Years Running

MACON, Ga. /ScoopCloud/ — LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced that company CEO and Founder Lori Brewer has been named to Mortgage Professional America (MPA) magazine’s list of 2018 Elite Women in Mortgage.

Simplifile’s Toni Carroll Receives Mortgage Professional America Award

PROVO, Utah /ScoopCloud/ — Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that National Settlement Account Manager Toni Carroll was honored by Mortgage Professional America among its list of 2018 Elite Women in Mortgage.

TRK Connection CEO Teri Sundh Named to MPA’s 2018 List of Elite Women in Mortgage

SALT LAKE CITY, Utah /ScoopCloud/ — TRK Connection (TRK), a leading provider of mortgage quality control and origination management solutions, announced today that CEO Teri Sundh has been named to Mortgage Professional America (MPA) magazine’s 2018 Elite Women in Mortgage.

Mid America Mortgage COO Kara Lamphere Repeats as One of MPA Magazine’s Elite Woman in Mortgage

ADDISON, Texas /ScoopCloud/ — Mid America Mortgage, Inc. today announced that Chief Operating Officer Kara Lamphere was named by Mortgage Professional America (MPA) magazine to the publication’s list of 2018 Elite Women in Mortgage. This is the second consecutive year that Lamphere has received this recognition.

MQMR’s Erin Harris Recognized by Mortgage Professional America as One of Its ‘2018 Elite Women in Mortgage’

LOS ANGELES, Calif. /ScoopCloud/ — Mortgage Quality Management and Research, LLC (MQMR), a leader in mortgage risk management and compliance services, today announced that Erin Harris, manager of MQMR’s vendor management division HQ Vendor Management, has been named by industry trade magazine Mortgage Professional America (MPA) as a 2018 Elite Women in Mortgage honoree.

Beckie Santos of IDS Honored with MPA Magazine’s 2018 Elite Women in Mortgage Award

SALT LAKE CITY, Utah /ScoopCloud/ — Mortgage document preparation vendor International Document Services, Inc. (IDS), announced today that New Product Development Manager Beckie Santos has been recognized by Mortgage Professional America (MPA) magazine in its list of 2018 Elite Women in Mortgage.

Credit Plus, DocMagic, Home Captain and Snapdocs Lead Fundraiser, Raising $1,500 for Girls Inc. Dallas at NEXT Women’s Mortgage Event

EDMOND, Okla. /ScoopCloud/ — NEXT Mortgage Events LLC, a creator of events for women mortgage executives, has announced that mortgage industry technology providers Credit Plus, DocMagic, Home Captain and Snapdocs collaborated as key benefactors in a charity effort that raised $1,500 for Girls Inc. of Metropolitan Dallas.

Simplifile Signs 1800th County to Its E-recording Network, Platform Now Utilized by More Than Half of U.S. Recording Jurisdictions

PROVO, Utah /ScoopCloud/ — Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that Clallam County, Wash., is the 1800th jurisdiction to join Simplifile’s e-recording network.

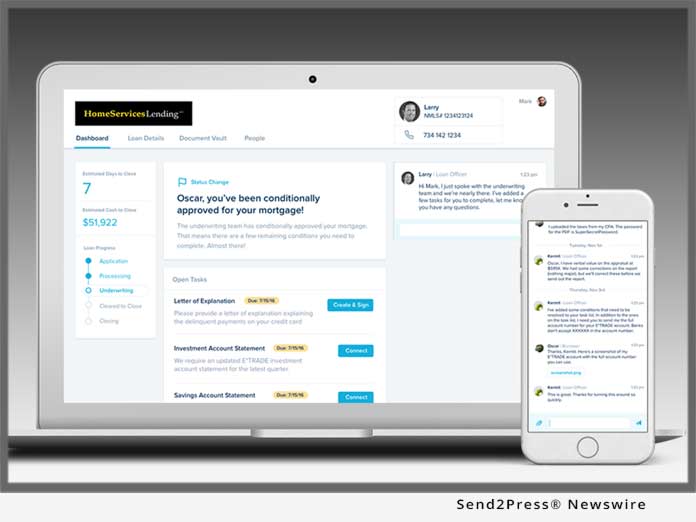

Maxwell Announces New Partnership with HomeServices Lending

DENVER, Colo. /ScoopCloud/ — Digital mortgage software provider, Maxwell, today announced a new partnership with HomeServices Lending of Des Moines, Iowa. Maxwell empowers mortgage lenders across the nation with a modern digital workspace that digitizes and automates the home-buying experience.

Mortgage Risk Management Firm MQMR Continues Corporate Philanthropy Efforts through Volunteer Day at Camp Impact

LOS ANGELES, Calif. /ScoopCloud/ — Mortgage Quality Management and Research, LLC (MQMR), a leader in mortgage risk management and compliance services, recently completed a volunteer day at Camp Impact as part of its on-going corporate commitment to community service. Camp Impact offers free summer camps to homeless and underprivileged youth in the Arlington and Grand Prairie, Texas, communities.

MorVest Capital Hires Ruth Lee as Executive Vice President for Expansion of Mortgage Liquidity and MSR Advisory Services

SUGAR LAND, Texas /ScoopCloud/ — David Fleig, CEO of MorVest Capital, LLC, a financial services advisory firm specializing in mortgage banking liquidity and capital solutions, today announced its addition of Executive Vice President Ruth Lee.

OpenClose Launches DecisionAssist Mobile for Originators

SAN FRANCISCO, Calif. /ScoopCloud/ — OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced at the California Mortgage Bankers Association (CMBA) 46th Annual Western Secondary Marketing Conference that it unveiled DecisionAssist(TM) Mobile, which provides fingertip access to the company’s proprietary web-based product and pricing engine (PPE)

ARMCO Releases Fourth Quarter / Calendar Year 2017 Trends Report

POMPANO BEACH, Fla. /ScoopCloud/ — ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report provides loan quality findings for mortgages reviewed by ACES Audit Technology(TM) during the fourth quarter (Q4) of 2017 as well as the 2017 calendar year (CY).

LBA Ware Recruits Mortgage Process Improvement Specialist Jessica Henke as Solutions Consultant

MACON, Ga. /ScoopCloud/ — LBA Ware(TM), a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced today that it has hired Jessica Henke as a solutions consultant to support the company’s implementation consulting and client success efforts. Henke will leverage her two decades of accounting and business process improvement expertise in mortgage lending to bring LBA Ware clients streamlined business workflow solutions and enhanced operational insights.

Accurate Group Enhances Its NotaryWorks Complete Notary Solution with Remote Online Notarization from NotaryCam

NEWPORT BEACH, Calif. /ScoopCloud/ — NotaryCam today announced that it has partnered with Accurate Group, a leading provider of technology-driven real estate appraisal, title and compliance services, to provide remote online notarization services for NotaryWorks(TM), Accurate Group’s complete notary solution.

Lykken on Lending June 25 Podcast Features Black Knight EVP Shelley Leonard on Mortgage Servicing in the Digital Age

AUSTIN, Texas /ScoopCloud/ — Lykken on Lending, the mortgage industry podcast created by mortgage lenders for mortgage lenders, is pleased to announce that its June 25 episode welcomes Shelley Leonard, EVP and Chief Product Officer for Black Knight, Inc. (NYSE:BKI).

Cloudvirga Named One of North America’s Top 100 Tech Firms by Red Herring

IRVINE, Calif. /ScoopCloud/ — Cloudvirga(TM), a leading provider of digital mortgage point-of-sale (POS) software whose enterprise technology is powered by the intelligent Mortgage Platform(r), was honored today with Red Herring’s Top 100 North America award.

Global DMS Adds Appraisal Pre-Scheduler Functionality to its eTrac Valuation Management Platform

LANSDALE, Pa. /ScoopCloud/ — Global DMS, a leading provider of cloud-based valuation management software, announced that it has rolled out eTrac Pre-Scheduler, a newly released tool that that streamlines appraisal appointments, allowing lenders and AMCs that are leveraging eTrac to easily set predetermined appraisal dates, apply specific parameters, and broadcast appraiser communications.

LBA Ware Celebrates Its 10th Anniversary Serving the Mortgage Industry

MACON, Ga. /ScoopCloud/ — LBA Ware, a leading provider of automated compensation software and systems integration solutions for mortgage lenders, announced it has achieved a decade in business this year. The company celebrated the official anniversary of its founding on June 10, the date of the company’s incorporation.

ARMCO Promotes Sharon Reichhardt to Vice President of Client Success

POMPANO BEACH, Fla. /ScoopCloud/ — ACES Risk Management (ARMCO), the leading provider of enterprise transaction and loan risk mitigation software solutions, has announced that former director of client services Sharon Reichhardt has been promoted to vice president of client success.

Two Tech Startups to Debut Technology at NEXT Mortgage Conference

DALLAS, Texas /ScoopCloud/ — NEXT Mortgage Events LLC, creator of the only mortgage technology conference for women executives, has announced that startup tech firms ProxyPics and Zipwhip will debut their technology to the mortgage industry at the second biannual NEXT mortgage technology conference, which takes place on June 21-22, 2018 at Hotel ZaZa in Dallas.

Simplifile’s E-recording Platform Utilized by Recording Districts Representing More Than 80-percent of the U.S. Population

PROVO, Utah /ScoopCloud/ — Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, today announced that 31 additional recording jurisdictions located in 16 states throughout the Midwestern, Southwestern, and Western United States have joined Simplifile’s e-recording network.

United Fidelity Funding West Hires Victoria Dunn as National Wholesale Account Executive

IRVINE, Calif. /ScoopCloud/ — United Fidelity Funding West (UFFWest), a rapidly growing national mortgage banker, announced that it added Victoria Dunn to its wholesale lending team of account executives. Ms. Dunn possesses a demonstrated history in negotiation, business development, account management, direct sales, product marketing, technology, and essentially all facets of mortgage lending.

OpenClose Recruits LOS Development Expert Joseph Wade to Further Innovate and Enhance Existing Software Solutions

WEST PALM BEACH, Fla. /ScoopCloud/ — OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it has added senior software LOS and mortgage software development expert Joseph Wade to its growing development team. Joseph was previously at Finastra (formerly D+H) and will play an integral role in software innovation and enhancements at OpenClose.

NotaryCam Celebrates 100K Online Notarizations with Live Demo at National Settlement Services Summit (NS3) 2018

NEWPORT BEACH, Calif. /ScoopCloud/ — NotaryCam, Inc. today announced that it has completed more than 100,000 online notarizations since introducing the service in 2012. To celebrate this milestone, NotaryCam will offer free demos of its eClose360 platform to attendees of the 2018 National Settlement Services Summit (NS3) being held June 6-8 at the Marriott Renaissance Center in Detroit.

ARMCO Hires Industry Veteran Nick Volpe as Chief Strategy Officer

POMPANO BEACH, Fla. /ScoopCloud/ — ACES Risk Management (ARMCO), the leading provider of enterprise financial risk mitigation software solutions, has announced that it has hired Nick Volpe as chief strategy officer. Volpe’s expertise stems from over 23 years of mortgage operational and QC experience.